This is not a commonly discussed topic.

However, in light of the global problems in the current times, we wanted to talk a little about the ways we think and invest. Should they become more socially responsible and sustainable, we might just be able to bring about some systemic change and progress.

Public companies provide their annual reports and financial standings which help investors make decisions. However, there are more investors who are also interested in companies that sustain similar results while being socially inclusive and responsible.

Sustainable investing involves choosing businesses that focus on Environmental, Social and Governance (ESG) aspects. Another term commonly used is Socially Responsible Investing (SRI). These companies do not just aim to deliver financial returns but to make a positive, ethical impact on the world as well.

For some, this involves choosing to invest in companies that contribute to the LGBTQ+ community.

What is a LGBTQ+ friendly company?

How does one measure that and how do I find them?

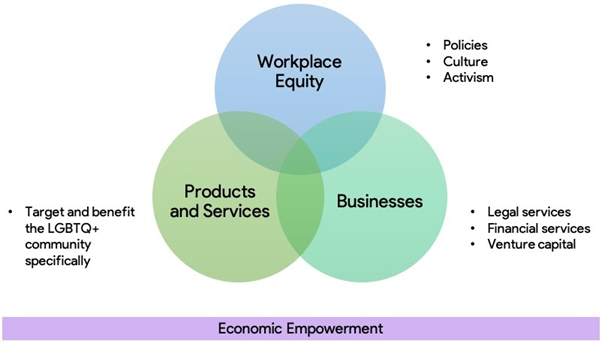

Figure 1 What makes a company queer friendly?

Figure 1 What makes a company queer friendly?

We think of LGBTQ+ engagement in 3 aspects – Workplace equity, products and services, and businesses and access to capital.

Workplace equity is often the first aspect investors focus on. Does a company’s policies, culture, and activism benefit the LGBTQ+ community? Internally, some companies implement policies that are tailored to the needs of LGBTQ+ employees such as inclusive healthcare benefits and non-discriminatory standards for business partners and clients. Things to look out for externally include whether they donate and support LGBTQ+ events. For e.g. Remember how Cathay applied to MDA to screen a promotional video for Pink Dot in their cinemas in 2015? They got rejected but Cathay’s stance was clear and appreciated.

Organisations such as the Human Rights Campaign measure these areas and rate companies. Results are published in the Corporate Equality Index 2020. While Asia takes a while to catch up in this area, this is a good starting point to develop a LGBTQ+ investment lens. For a local touch, one can look at local companies who sponsor LGBTQ+ events such as PinkDot. (https://reddotforpinkdot.sg/sponsors/) (Do drop us a message if you know of any other businesses and events we should take note of!)

After filtering and picking out a few potential investment choices, you can check out each company’s website and reports. There will be information about diversity and inclusion efforts under the Careers and Culture sections. Sometimes, you can get a quick read on a company’s culture from employees’ social media or reviews on sites like Glassdoor too.

Products and services is another area to consider. This ranges from dating apps to pharmaceutical companies investing in medications that could reduce the risk of HIV infection and mental health services specifically catered to the LGBTQ+ community.

Some businesses may not have the LGBTQ+ folks as their only target market, but still allocate significant resources to the community. For example, some legal and financial advisory firms may have a large emphasis on serving the needs of the community, alongside other clients.

It might seem like the best option to invest where all 3 areas overlap (Figure 1.). However, it is more likely to end up with just 1 or 2 areas and that’s ok. To add on, although individual stocks can be a good addition to a portfolio, a broader index-based approach to investing through Exchange Traded Funds (ETFs) can be useful as well. While most ETFs are not exclusively committed to LGBTQ+, you can still look out for those that are inclined towards ESG/SRI. These sometimes promote gender diversity and LGBTQ+ inclusion. You can also connect with investment and financial advisory professionals to gain access and updates to such funds and other asset classes.

Do they give better returns?

Results suggest that these practices may well improve returns. A 2016 Credit Suisse report found that a basket of 270 LGBT-friendly stocks outperformed a broad index by three percentage points in the prior six years. The LGBTQ100 Index of LGBT-friendly companies beat the S&P 500 index – which tracks the stocks of 500 large U.S. companies – by 3.4% in the first six months of 2020, LGBTQ Loyalty said.

“There is something behind LGBT-inclusive practices that spills over to all employees,” says John N. Roberts, partner and portfolio manager at Denver Investments. “Our 20 years of research suggests that when companies treat their employees better they get better performance, and that leads to higher shareholder returns.” With better inclusivity, a company’s employees will feel more valued, improving a company’s ability to attract and retain talent. This may improve a company’s overall performance.

That being said, investors should be careful about jumping to conclusions. This is just one aspect. We don’t suggest that there is a causal relationship between investment performance and a company’s policies, but it just so happens that better performing companies do have strong LGBTQ+ friendly policies.

What can I do to start?

While it is still challenging to directly invest in pro-LGBTQ+ causes, more companies are stepping up in their effort to show support. Future investment options are likely to be launched too. In the meantime, we can stay updated on LGBTQ+ friendly workplaces and those who go the extra mile to ensure that there is a LGBTQ+ network chapter and support within the organisation. There are also those that collaborate with other organisations that are LGBTQ+ and/or allies. Red Dot for Pink Dot group of local sponsors is a good place to start. Be Inclusive – a registry of inclusive companies in Singapore is another resource you can check out.

Besides buying shares, there are also many other ways to invest in the community – some might want to donate to LGBTQ+ causes or organisations instead. Just to name a few options, W!ld Rice and The Projector show queer plays and films, while GayhealthSG under Action For AIDS provides Gay and Bi men friendly sexual health services. Some might want to dedicate their time and effort. If we create financial economic empowerment that drives through and flows to people who are supportive of inclusivity and equality, pot of gold at the end of the rainbow or otherwise, it comes around.

Adopting an LGBTQ+ lens is one of the many ways an investor can start to understand the risks of social discrimination, and the opportunities that come with making choices that can benefit the LGBTQ+ community. Cheers to doing more and doing better!

Credits:

https://www.nerdwallet.com/blog/investing/how-to-build-an-lgbt-friendly-portfolio/

https://open-for-business.org/

https://www.reuters.com/article/us-usa-lgbt-investment-feature-trfn-idUSKBN2613MR

——————————————–

Disclaimer: The views expressed belong solely to the individual contributors in their individual capacities and do not necessarily reflect those of their respective employers, organisation or other group. Any information provided does not constitute legal, financial or any kind of advice. You should obtain specific advice suitable for your circumstances from an appropriate professional before taking any action. Although we try our best to ensure the accuracy of the information on this website, you rely on it at your own risk. We welcome feedback relating to factual accuracy via email at info@prident.co.